Commencement of statutes refers to the date when a law comes into effect, as specified in the statute, upon assent, or via government notification. It ensures legal rights and obligations begin at a defined time, impacting compliance, enforcement, and interpretation of laws.

Key Takeaways:

- Commencement defines when a law takes legal effect, shaping its applicability.

- Statutes can start on a specified date, assent, notification, or after certain conditions are met.

- Understanding commencement ensures clarity on when legal rights and obligations apply.

- Laws usually apply prospectively unless explicitly stated to have retrospective effect.

- The General Clauses Act, 1897, provides a framework for interpreting commencement in India.

- Courts clarify disputes on commencement, ensuring smooth application of statutes.

Interpretation of Statutes is a vital function of the judiciary, which involves determining the meaning and application of legislation or statutes done by the parliament.

One important aspect of this process is understanding the commencement of statutes or the point/time at which a statute begins to have legal effect.

General Principles of Commencement of Statutes

The commencement of a statute refers to the time a legislative enactment begins to have legal force and effect.

It marks the transition of a statute from being a mere document of legislative intent to becoming a binding law that imposes rights, obligations, and duties upon individuals and entities.

Understanding the commencement of statutes is fundamental to the interpretation and application of legislation.

A statute’s commencement may be expressly stipulated within its provisions or determined by other external mechanisms prescribed in the statute.

In cases where no specific commencement date is mentioned, general principles and statutory interpretation rules, such as those found in India’s General Clauses Act, 1897, guide its operation.

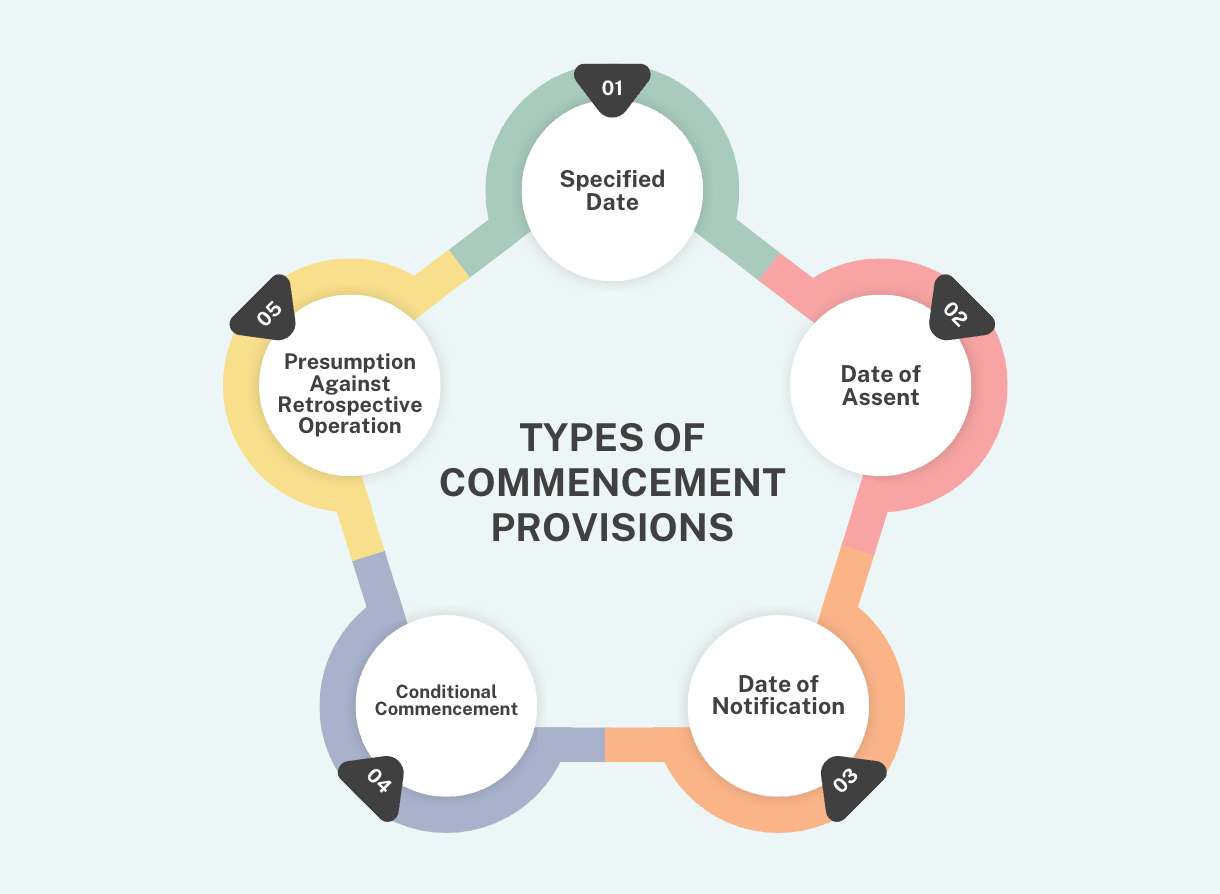

Types of Commencement Provisions

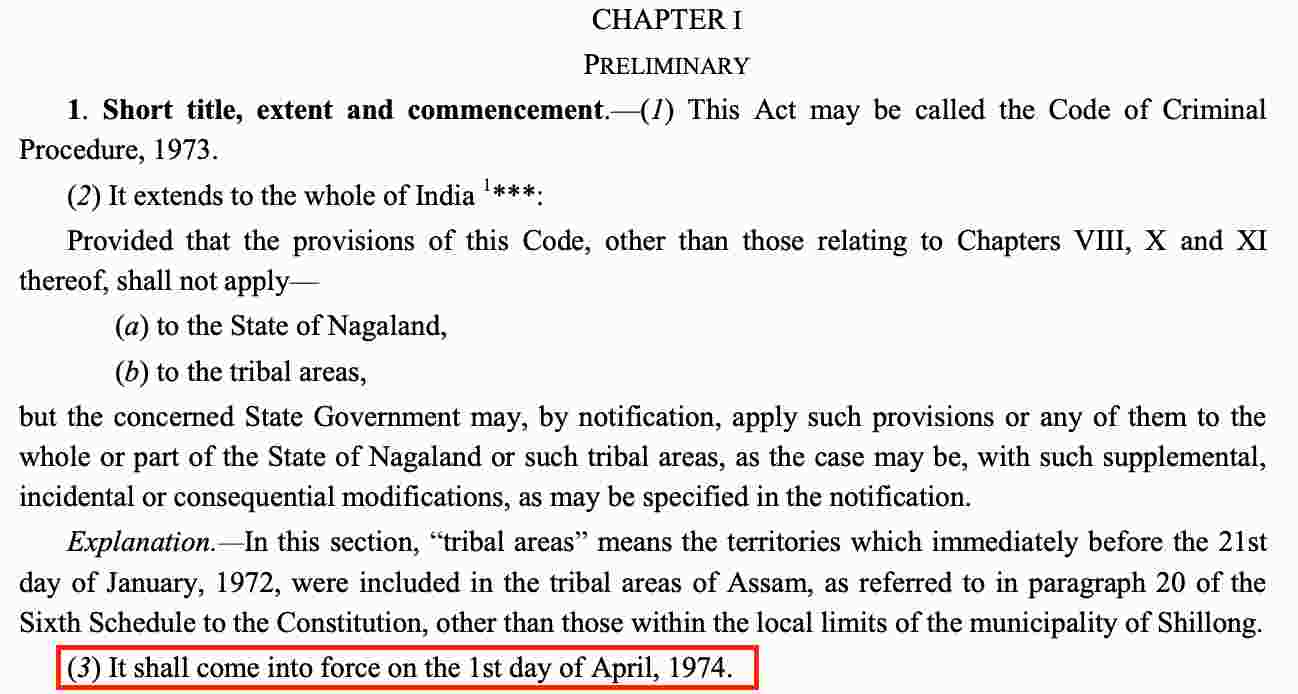

#1 Specified Date

A statute may explicitly mention the date on which it comes into effect.

For instance, if a statute states, “This Act shall come into force on the 1st of January, 2024,” then the commencement date is unambiguous.

#2 Date of Assent

Sometimes, the statute may come into force on the date it receives the assent of the President or the Governor.

For example, many Indian statutes state, “This Act shall come into force on the date of its assent by the President.”

#3 Date of Notification

Some statutes may specify that they will come into force on a date appointed by the government, which is then announced through an official notification.

This method provides flexibility to the government in deciding the precise date based on administrative convenience.

#4 Conditional Commencement

Occasionally, the commencement of a statute might depend on the occurrence of a specific event or fulfillment of certain conditions.

For instance, a statute could state, “This Act shall come into force on such date as the Central Government may, by notification in the Official Gazette, appoint.”

#5 Presumption Against Retrospective Operation

Statutes are presumed to operate prospectively unless the language of the enactment expressly or by necessary implication provides for retrospective application.

This principle ensures fairness by safeguarding individuals from the retroactive imposition of legal obligations.

Importance of Commencement of Statutes

The commencement of statutes is a critical aspect of legislative processes, as it determines when a law becomes operative and enforceable.

Specifying the commencement date is vital to ensure clarity and avoid confusion for all stakeholders involved, including the government, judiciary, businesses, and the general public. Below are some key points highlighting its importance:

#1 Legal Certainty and Clarity

The commencement date establishes a clear point in time when the rights, duties, and obligations created by the statute become effective.

This prevents disputes over whether a law applies to actions or events before or after a specific date, ensuring consistency in its application.

#2 Determining Prospective or Retrospective Application

Laws are generally presumed to apply prospectively unless explicitly stated otherwise. The commencement date helps determine the scope of the law’s application and whether it impacts events or transactions already concluded.

For example, tax laws often include clear commencement provisions to avoid retroactive financial implications.

#3 Ensuring Compliance

For laws introducing new obligations, the commencement date allows individuals, businesses, and organizations time to prepare for compliance.

For instance:

- A law mandating the use of renewable energy might specify a commencement date months ahead, giving industries time to transition and adapt their processes.

#4 Coordination Between Laws

In cases where a new law amends or repeals an existing one, the commencement date helps maintain continuity and ensures that transitional provisions operate effectively.

This avoids gaps in the legal framework that might lead to confusion or legal challenges.

#5 Administrative Flexibility

For statutes that depend on government notification for their commencement, flexibility in setting the date allows administrative agencies to prepare for smooth implementation.

This is particularly useful for laws requiring significant groundwork, such as setting up new institutions or systems.

Practical Implications of Commencement Provisions

- Implementation Deadlines: The commencement date is essential for government agencies to prepare regulations, systems, or infrastructure necessary to enforce the law. For example, the implementation of the Goods and Services Tax (GST) in India was preceded by extensive groundwork to ensure a seamless transition on the commencement date.

- Compliance Timelines for Stakeholders: Businesses and individuals often depend on the commencement date to align their operations with the new legal requirements. For instance, in tax or environmental legislation, the commencement date signals when compliance becomes mandatory.

- Legal Advice and Strategic Planning: Lawyers and legal practitioners rely on clear commencement provisions to advise their clients on how new laws will impact them. For instance, if a statute imposing penalties on non-compliance with labor laws commences on January 1, companies must ensure compliance before that date to avoid fines.

- Litigation and Disputes: Ambiguity in commencement provisions can lead to legal challenges. For example, if a law’s commencement is tied to a specific event without clarity, stakeholders may contest its applicability, leading to prolonged litigation.

Commencement of Statutes in Indian Context

In India, the interpretation of statutes, including their commencement, follows principles laid down by the judiciary and legislative practices.

The General Clauses Act, of 1897, plays a vital role in this regard. This Act provides definitions and rules for interpreting Indian statutes, including the commencement of laws.

General Clauses Act, 1897

The General Clauses Act, 1897, is a cornerstone of Indian statutory interpretation, offering standardized rules for understanding legislative provisions. Section 5 of the Act explicitly addresses the commencement of statutes.

Provisions of Section 5:

- Commencement by Assent: If a statute does not specify a commencement date, it is deemed to come into force on the date it receives assent. For central legislation, this refers to the President’s assent, and for state laws, the Governor’s assent.

- Specified Date: When a statute mentions a specific commencement date, it becomes operative from that date.

- Notifications: Certain statutes empower the government to determine the commencement date through official notifications, published in the Gazette.

Illustrative Example: Consider the implementation of the Goods and Services Tax (GST) Act in India. While the law was passed in 2017, different sections were notified at different times, ensuring a phased rollout.

Challenges and Critiques in the Commencement of Statutes

The commencement of statutes, while a crucial element of the legislative process, often gives rise to various challenges and critiques that can affect the efficacy and clarity of the law.

These issues stem from ambiguities in the drafting of commencement provisions, delays in their implementation, and conflicts between newly enacted laws and existing legal frameworks.

Ambiguity in Commencement Provisions

One of the primary challenges in the commencement of statutes arises from the ambiguity in the wording of the commencement clauses.

A statute may either fail to explicitly define its commencement date or provide insufficient detail regarding the conditions under which it shall come into force.

This creates uncertainty and can lead to legal disputes, particularly when there is no clear indication of whether the statute is intended to apply retroactively or prospectively.

In many instances, the use of phrases such as “the Act shall come into force on such date as the Government may, by notification in the Official Gazette, appoint” can lead to confusion regarding the precise date of commencement, especially when the notification is delayed or not issued within a reasonable time.

In these cases, it may not be clear when the rights, duties, or obligations imposed by the statute will be applicable.

Furthermore, the General Clauses Act, 1897, while offering a default rule for commencement (i.e., the date of assent), does not always resolve issues where no commencement date is specified within the Act itself.

Judicial interpretation may be required to determine whether the statute is intended to apply from the date of assent or whether it requires a further act of the executive, such as a government notification, to activate it.

Delays in Implementation and Notification

Another significant issue is the delay in the issuance of a notification to bring the statute into force.

Legislative bodies may enact a statute, but its operationalization is contingent upon a subsequent executive action, such as a government notification, setting the commencement date.

This delay can occur due to various reasons, such as administrative inertia, logistical challenges, or political considerations.

The consequences of such delays can be far-reaching, particularly when the statute addresses time-sensitive issues such as tax rates, criminal laws, or public health.

For example, the delay in the notification of a newly enacted tax law can result in confusion for taxpayers, who may remain unsure of whether they are bound by the provisions of the new law or the old regime.

Similarly, when criminal statutes or amendments to criminal procedure laws are not promptly brought into force, there may be a legal vacuum, with courts and law enforcement agencies left uncertain about which law applies to ongoing cases.

Such delays also undermine the predictability of the legal system, an essential feature of the rule of law.

Citizens, businesses, and other stakeholders may find themselves in a situation where they are unsure of the law’s application, potentially leading to inadvertent non-compliance or disputes over liability.

Conflicts Between New and Existing Laws

The commencement of new statutes can also lead to conflicts with existing laws, especially when the new statute alters or amends provisions in a way that creates discrepancies between different pieces of legislation.

This issue is particularly prevalent when the commencement date of a statute overlaps with the repeal or amendment of existing provisions.

The issue of “legal vacuums” arises when a new statute alters the legal landscape but is not fully operational at the time of its enactment, leaving a period where there is no clear legal rule governing a specific subject.

The repeal or amendment of older laws without the immediate commencement of the new statute can create a temporary gap in legal regulation, potentially leading to a situation where neither the old nor the new legal provisions are applicable, and no legal recourse is available for affected parties.

Additionally, retroactive application (where the statute applies to actions or events that occurred before its enactment) can lead to conflicts with established principles of law, such as the principle of lex prospicit non respicit (the law looks forward, not backward).

The retrospective application of a statute may be controversial and often gives rise to challenges on the grounds of fairness, especially if it alters the legal status or liabilities of parties involved in past transactions or events.

Judicial Challenges and Interpretation

Judicial intervention often becomes necessary when the commencement provisions of a statute are unclear or lead to conflicting interpretations.

Courts may be required to determine whether a statute applies prospectively or retrospectively, particularly when the language of the statute does not expressly address this issue.

The judiciary’s role in resolving such disputes can be complicated by differing interpretations of legislative intent and the broader implications for legal certainty and individual rights.

For instance, in cases involving the retrospective operation of tax laws or criminal statutes, the judiciary may have to balance the legislature’s intent with constitutional safeguards, such as the protection of vested rights and the prohibition against ex post facto laws.

The courts often look to legislative history, debates, and the wording of the statute itself to interpret whether the legislature intended the law to have retroactive effect.

In some instances, judicial review may be triggered by challenges to the delay in the commencement of statutes, particularly when it is argued that such delays violate constitutional principles or infringe upon individual rights.

Courts may examine whether the executive’s failure to issue a notification within a reasonable time constitutes an unlawful exercise of power or a failure to fulfill the legislative intent.

Legal Uncertainty and Public Confusion

Finally, the ambiguity surrounding the commencement of statutes can create legal uncertainty and confusion for the general public.

When citizens are uncertain about when a statute comes into force, they may not fully comprehend their legal obligations, leading to non-compliance or misunderstandings.

This issue is particularly pronounced in areas like taxation, public safety, and regulatory compliance, where precise legal knowledge is critical to avoiding penalties.

Public awareness of the commencement date is crucial to ensure that the new law is effectively implemented and that stakeholders understand their rights and responsibilities under it.

Legal practitioners, businesses, and the public at large often rely on clear and timely information regarding the commencement of statutes to plan their actions accordingly.

Case Laws on Commencement of Statutes

Indian courts have extensively interpreted the commencement of statutes, particularly in scenarios involving ambiguity or disputes about retrospective application.

Govinddas v. Income Tax Officer (1976)

- Issue: Whether certain amendments to tax law could be applied retrospectively.

- Judgment: The Supreme Court ruled that unless explicitly stated, statutes are presumed to apply prospectively. The Court emphasized that retrospective operation affects vested rights, and clear legislative intent is necessary for such application.

- Significance: This case highlights the presumption in favor of prospective operation and underscores the importance of commencement dates in determining a law’s temporal application.

Keshavan Madhava Menon v. State of Bombay (1951)

- Issue: Validity of proceedings under pre-Constitution laws following the commencement of the Constitution.

- Judgment: The Supreme Court held that laws inconsistent with the Constitution became inoperative from January 26, 1950, the date of its commencement. However, actions already completed under such laws remained valid.

- Significance: This case demonstrates how the commencement of the Constitution itself impacted the operation of existing laws, creating a pivotal transitional framework.

State of Punjab v. Amar Singh Harika (1966)

- Issue: When did a service-related statutory rule come into effect?

- Judgment: The Supreme Court held that rules requiring publication in the Gazette come into force only after such publication. This aligns with the principle that statutory notifications must be publicized to be enforceable.

- Significance: The case reinforces the importance of official notifications in determining the commencement of laws and regulations.

ITO v. Thomas Abraham (1968)

- Issue: Applicability of a law from the date of assent or notification.

- Judgment: The Kerala High Court clarified that if a statute specifies its commencement by notification, the law cannot be enforced before such a notification, even if it has received assent.

- Significance: This case illustrates conditional commencement and the role of administrative discretion in setting operational timelines.

Judicial Principles on Commencement

- Prospective Application: Laws are presumed to apply to future events unless retroactivity is expressly stated.

- Role of Notifications: Government notifications play a critical role in activating conditional statutes.

- Transitional Challenges: Commencement dates can affect rights and obligations under old laws, requiring careful judicial balancing.

- Interpretation in Favor of Clarity: Courts consistently aim to clarify ambiguities in commencement provisions to avoid uncertainty for stakeholders.

Frequently Asked Questions (FAQs)

What is meant by the commencement of a statute?

The commencement of a statute refers to the specific time or date when the provisions of a law become effective and begin to apply. This could be a date specified in the statute, the date of assent, or a date notified by the government.

How does a statute come into effect?

A statute can come into effect in several ways: through a specified date, the date of assent, a government notification, or upon the fulfillment of certain conditions.

What is the difference between retrospective and prospective commencement?

Prospective commencement means the law applies only from the date it comes into force, affecting future events. Retroactive commencement applies the law to events that occurred before it came into force, affecting past actions.

Can a statute come into force immediately after assent?

Yes, some statutes may come into force immediately after receiving the assent of the President or Governor, though the actual commencement date is typically specified in the statute.

What is the role of the General Clauses Act, 1897 in the commencement of statutes?

The General Clauses Act, 1897, provides guidelines on the commencement of statutes in India. Section 5 of the Act states that if no commencement date is specified, the statute will come into force on the date it receives assent.

Can the commencement date of a statute be changed after it is passed?

Yes, a statute may specify that its commencement will depend on a notification by the government. This allows flexibility, meaning the government can decide the exact commencement date based on administrative convenience.

How does the government notify the commencement of a statute?

The government can notify the commencement of a statute by publishing a notification in the Official Gazette, specifying the exact date the statute or its provisions will come into force.

Are there any exceptions to the general rule of prospective operation of statutes?

Yes, a statute can explicitly state that it operates retroactively. In such cases, it will apply to events or actions that occurred before the statute came into effect.

What happens if a statute does not specify its commencement date?

If a statute does not specify its commencement date, it is presumed to come into force on the date it receives assent, as per the General Clauses Act, 1897.

Why is the commencement of a statute important in legal practice?

The commencement of a statute is crucial because it determines when its provisions begin to apply, impacting rights, obligations, and legal compliance. Legal practitioners must understand the commencement dates to advise clients accurately and avoid legal conflicts.

Verdict

The commencement of statutes is a fundamental aspect of statutory interpretation that ensures the smooth application of laws.

In the Indian context, the principles laid out in the General Clauses Act, of 1897, and judicial interpretations provide a clear framework for understanding when statutes come into effect.

By comprehending these principles, all stakeholders can better explore the legal landscape, ensuring that laws serve their intended purpose from the correct point in time.