In company law, a business is treated as a separate legal person, independent from the people who own or manage it.

This separation is often described as the “corporate veil.” It allows shareholders and directors to run a company without being personally responsible for its debts or liabilities.

While this protection is essential for encouraging business and investment, it is not meant to be misused.

The idea of lifting the corporate veil becomes important when this legal separation is abused.

Courts are willing to look beyond the company’s separate identity when it is clear that the company is being used as a device to hide wrongdoing.

If individuals use the company to commit fraud, avoid legal duties, or escape financial responsibility, the court may disregard the company’s independent status and fix liability on the people controlling it.

Although the principle of separate legal personality is well established, courts do not apply it blindly.

Judges focus on the real nature of the transaction and the conduct of those behind the company.

When justice demands it, the law permits the court to uncover the reality behind the corporate structure instead of accepting it at face value.

This doctrine has real consequences for shareholders, directors, and creditors.

Shareholders and directors must remember that limited liability is not a licence to act dishonestly or irresponsibly.

Poor governance or misuse of the company can lead to personal liability. For creditors, lifting the corporate veil offers protection against artificial arrangements designed to defeat their claims.

In this way, the doctrine ensures that the corporate form serves legitimate business purposes and does not become a shield for unfair or unlawful conduct.

What Is the Corporate Veil?

The corporate veil refers to the legal distinction between a company and the individuals who constitute it.

Under company law, a company is treated as a separate legal entity, meaning it has an independent existence apart from its shareholders and directors.

This separation forms the foundation of the corporate veil and allows the company to own property, enter into contracts, sue, and be sued in its own name, without involving its members personally.

Concept of Separate Legal Entity

The concept of a separate legal entity implies that once a company is incorporated, it acquires a legal personality of its own.

The rights, obligations, and liabilities of the company are distinct from those of its members.

As a result, shareholders are generally not personally liable for the company’s debts beyond their agreed contribution.

This principle promotes commercial certainty and encourages investment by limiting individual risk.

Origin and Evolution of the Corporate Veil Doctrine

- The doctrine of the corporate veil was developed through judicial interpretation to strengthen the principle of separate legal personality.

- Courts initially followed this principle strictly to promote economic growth and business stability.

- With time, courts recognized that the corporate structure could be misused by individuals.

- This realization led to the development of exceptions to the general rule.

- Courts began lifting the corporate veil in cases involving fraud, improper conduct, or abuse of legal provisions.

- Although the doctrine remains well established, it has evolved to ensure justice and fairness are not defeated.

Difference Between the Company and Its Members

| Basis | Company | Members (Shareholders) |

| Legal status | A separate legal person created by law upon incorporation | Natural or legal persons who form or invest in the company |

| Existence | Exists independently of its members | Have an existence separate from the company |

| Liability | Liable for its own debts and obligations | Liability is generally limited to the amount invested or guaranteed |

| Ownership of property | Owns property in its own name | Do not own company property personally |

| Acts and obligations | Acts bind the company itself | Personal acts do not bind the company |

| Continuity | Enjoys perpetual succession | Membership may change without affecting the company |

| Capacity to sue or be sued | Can sue and be sued in its own name | Cannot sue or be sued for company acts in a personal capacity |

| Protection under corporate veil | Enjoys separate legal identity | Protected from personal liability as long as the veil is not lifted |

Meaning of Lifting (or Piercing) the Corporate Veil

Lifting the corporate veil refers to a legal situation where a court looks beyond the company’s separate legal personality and holds the individuals behind it, such as directors, promoters, or shareholders, personally responsible for the company’s actions or liabilities.

Normally, a company is treated as a legal person distinct from its members. However, this protection is not absolute. When the corporate structure is misused, courts may remove this “veil” to reveal the real actors controlling the company.

Legal Definition of Lifting the Corporate Veil

In legal terms, lifting the corporate veil means disregarding the company’s separate legal identity to fix liability on those who are actually in control. This is not done lightly.

Courts exercise this power only when there is clear evidence that the corporate form is being used to commit fraud, evade legal obligations, or defeat the purpose of the law.

The focus is not on the company itself, but on the conduct of the people hiding behind it.

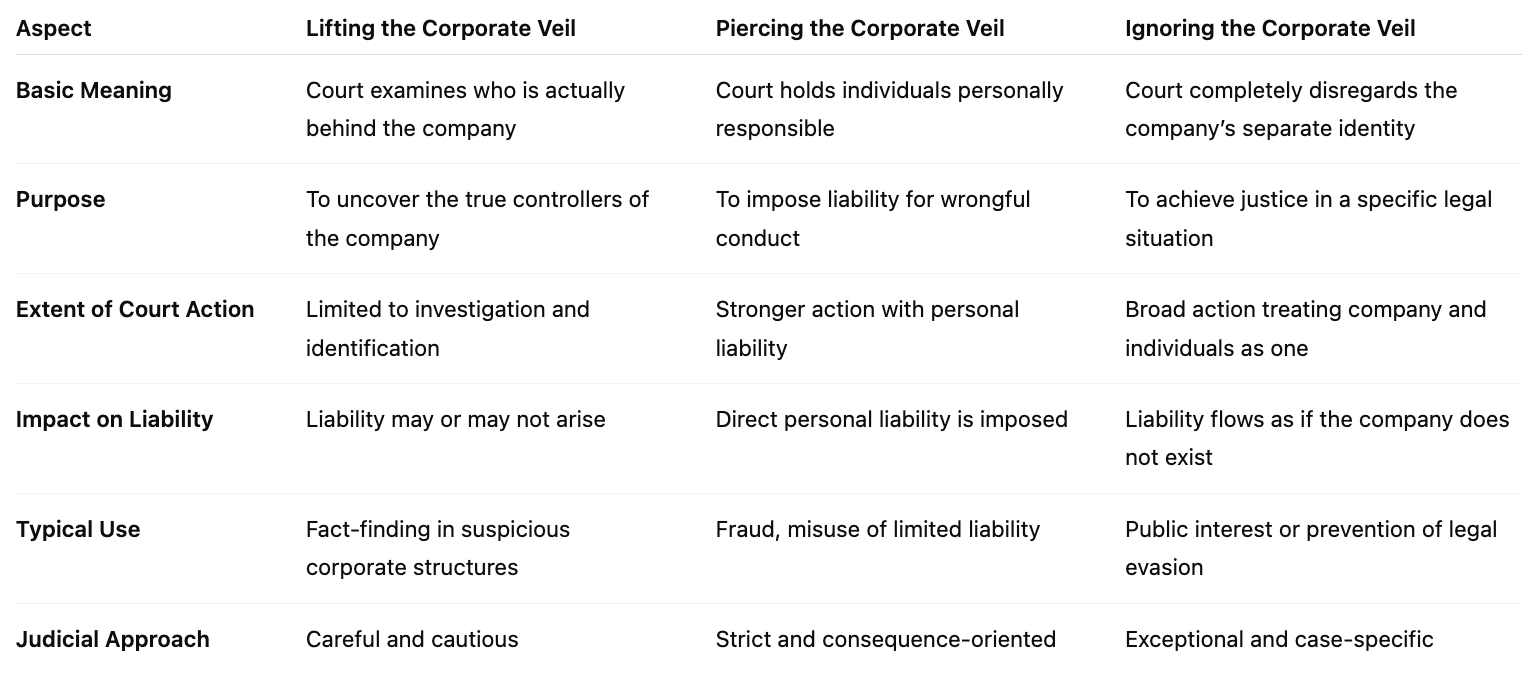

Lifting vs Piercing vs Ignoring the Corporate Veil

The expressions lifting, piercing, and ignoring the corporate veil are often used interchangeably, but they carry slightly different shades of meaning.

Lifting the veil generally means examining who is behind the company.

Piercing the veil goes a step further by imposing direct liability on those individuals.

Ignoring the veil is a broader idea where courts completely set aside the company’s separate identity for a specific legal purpose.

In practice, courts focus more on substance than terminology.

Purpose Behind Lifting the Corporate Veil

- To prevent misuse or abuse of the corporate structure

- To ensure limited liability is not used to protect dishonest or fraudulent conduct

- To hold the real individuals behind the company accountable

- To protect the interests of creditors and other affected parties

- To safeguard public interest and prevent legal evasion

- To maintain fairness and justice in the application of law

- To ensure that legal obligations cannot be avoided through technical incorporation formalities

Legal Basis for Lifting the Corporate Veil

The legal foundation for lifting the corporate veil is drawn from specific statutory provisions and well-established judicial principles.

Legislatures and courts recognize that while a company has a separate legal personality, this protection cannot be used to justify unlawful or unfair conduct.

Statutory Provisions Allowing Lifting of the Corporate Veil

Under the Companies Act, 2013, several provisions allow courts and authorities to look beyond the company and fix personal liability on individuals in control.

- Section 339 empowers the court to hold directors personally liable in cases of fraudulent conduct during the winding-up of a company.

- Section 35 imposes civil and criminal liability for misstatements in a prospectus, making directors and promoters accountable.

- Section 447 deals with punishment for fraud and allows piercing of the corporate veil where business is carried on with intent to deceive.

- Section 34 also applies where false or misleading statements are made to induce investment.

Apart from company law, tax statutes such as the Income Tax Act, 1961 permit authorities to lift the veil in cases of tax evasion and sham transactions.

Labour and environmental laws similarly impose direct liability on persons in charge when statutory obligations are deliberately avoided through corporate structures.

Judicial Principles Developed by Courts with Key Case Laws

Courts have developed the doctrine of lifting the corporate veil through landmark judgments, emphasizing that the true nature of transactions and control must prevail over the company’s formal legal structure. The following case laws clearly illustrate how and when courts have applied these principles.

In Salomon v. A. Salomon & Co. Ltd., the House of Lords affirmed the principle of separate legal personality. However, this case also laid the groundwork for future exceptions by recognizing that the doctrine is not absolute and may be departed from in appropriate circumstances.

In Gilford Motor Co. Ltd. v. Horne, the court lifted the corporate veil where a company was formed solely to evade a contractual non-compete obligation. The company was held to be a mere façade created to conceal the true intention of the individual controlling it.

The Supreme Court of India, in Life Insurance Corporation of India v. Escorts Ltd., clarified that the veil may be lifted where the corporate personality is used for tax evasion, fraud, or to circumvent law. The Court emphasized that while lifting the veil is an exception, it becomes necessary when public interest or justice so demands.

In Delhi Development Authority v. Skipper Construction Co., the Court lifted the veil after finding that multiple corporate entities were used to defraud investors. The judgment stressed that courts are not bound by corporate structures designed to mask dishonest conduct.

Similarly, in State of Uttar Pradesh v. Renusagar Power Co., the Supreme Court treated a subsidiary as part of the parent company where the corporate form was used to avoid statutory obligations. The Court held that substance must prevail over form when justice requires intervention.

Role of Equity, Justice, and Public Interest

Equity and justice guide courts when statutory provisions alone are insufficient. Courts intervene where maintaining the corporate form would result in unfairness, fraud, or harm to public interest.

Protection of creditors, prevention of misuse of limited liability, safeguarding state revenue, and ensuring compliance with law are central considerations.

The doctrine is applied carefully to balance legitimate business autonomy with accountability and fairness.

When Can a Court Order for Lifting the Corporate Veil?

Courts do not lift the corporate veil as a routine matter. The principle of separate legal personality is fundamental to company law, and judges are generally cautious before disregarding it.

However, when the corporate structure is misused, courts may step in to prevent injustice, fraud, or abuse of law.

Circumstances Justifying Court Intervention

A court may order the lifting of the corporate veil when it becomes clear that the company is being used not as a genuine business entity, but as a device to hide the real actors behind it.

This typically happens where individuals controlling the company attempt to avoid legal responsibility, defeat statutory obligations, or shield themselves from liability by taking advantage of the company’s separate legal status.

Courts intervene when:

- The company exists merely as a façade

- The corporate form is used to defeat law or public policy

- The separation between the company and its controllers is artificial rather than real

In such situations, respecting the corporate veil would result in unfairness or allow wrongdoing to go unchecked.

Burden of Proof and Judicial Discretion

The burden of proof lies on the party seeking to lift the corporate veil. It must be clearly shown that the company’s separate identity is being abused. Mere ownership or control of a company is not enough.

Judges exercise wide discretion in these matters. They look beyond form and examine the substance of transactions, conduct of directors, and the true intention behind the corporate structure.

Due to this discretion, no rigid formula applies; each case is decided on its own unique facts.

Grounds on Which Courts Lift the Corporate Veil

Courts have identified several situations where lifting the corporate veil is justified. These grounds have developed through judicial decisions over time.

#1 Fraud or Improper Conduct

One of the strongest reasons for lifting the corporate veil is fraud.

- Use of Company as a Tool for Fraud: When a company is deliberately used to deceive creditors, investors, or authorities, courts will not allow its separate identity to protect those responsible. If the company is created or operated solely to commit fraud, the individuals behind it may be held personally liable.

- Concealment of True Facts: Courts are particularly critical when the corporate structure is used to hide the true nature of transactions or the identity of real decision-makers. If material facts are concealed to mislead others, the veil may be lifted to reveal who is actually in control.

In Gilford Motor Co. Ltd. v. Horne (1933), the defendant was a former employee of the plaintiff company and was bound by a non-competition clause that restrained him from soliciting the company’s customers. To evade this restriction, he incorporated a company in his wife’s name and carried on the prohibited business through that company. The court found that the company was formed solely to avoid the contractual obligation. It lifted the corporate veil and restrained both the individual and the company, holding that the company was merely a sham used to commit fraud.

In Delhi Development Authority v. Skipper Construction Co. (P) Ltd. (1996), the promoters of the company collected large sums of money from the public for housing projects but diverted the funds for personal use through a network of companies. The Supreme Court observed that the corporate structure was deliberately used to defraud investors. The court lifted the corporate veil and held the promoters personally liable, emphasizing that corporate personality cannot be used as a shield for fraudulent conduct.

#2 Evasion of Legal Obligations

A company cannot be used as a shield to escape legal duties.

- Avoidance of Tax, Statutory Duties, or Penalties: Where individuals transfer assets or income to a company solely to reduce tax liability or evade statutory obligations, courts may disregard the corporate entity. Tax avoidance through lawful planning is permitted, but tax evasion through sham arrangements is not.

- Circumventing Labor and Employment Laws: Courts have lifted the corporate veil where companies are structured to deny workers their legal rights, such as minimum wages, gratuity, or social security benefits. If multiple companies are created merely to fragment employment responsibilities, courts may treat them as one.

In Workmen of Associated Rubber Industry Ltd. v. Associated Rubber Industry Ltd. (1986), the parent company created a subsidiary and transferred certain assets to it with the intention of reducing the bonus payable to workers under labour laws. The Supreme Court examined the substance of the transaction and held that the subsidiary was created to avoid statutory obligations. The corporate veil was lifted, and both companies were treated as a single entity for determining workers’ benefits.

In State of Rajasthan v. Gotan Lime Stone Khanij Udyog (2016), companies attempted to avoid statutory royalty and tax liabilities by structuring transactions through related entities. The court held that where corporate arrangements are designed solely to evade legal duties owed to the State, the veil can be lifted to identify the real beneficiary and enforce the law.

#3 Sham or Façade Company

- Companies Formed Only on Paper: Some companies exist only in name, with no real business operations. These entities are often set up to hold assets, avoid liabilities, or conduct questionable transactions.

- Absence of Genuine Business Activity: When a company has no independent employees, offices, or decision-making processes, courts may conclude that it is merely a façade. In such cases, the law looks through the company to the individuals behind it.

In Jones v. Lipman (1962), the defendant entered into a contract to sell land but later transferred the property to a company formed specifically for that purpose to avoid completing the sale. The court found that the company was a mere façade and described it as a “mask” used to hide the real facts. The corporate veil was lifted, and specific performance was ordered against both the individual and the company.

In Re Darby, ex parte Brougham (1911), a company was formed with no real business activity and existed only on paper to carry out improper transactions. The court disregarded the company’s separate identity and held the individuals behind it responsible, observing that the company had no genuine independent existence.

#4 Agency or Alter Ego Doctrine

- Company Acting as an Agent of Shareholders or Directors: If a company acts entirely under the instructions of its shareholders or directors, without exercising its own judgment, courts may treat it as their agent rather than an independent entity.

- Lack of Independent Decision-Making: Where all decisions are taken personally by individuals and the company merely executes them, the distinction between the company and its controllers becomes meaningless. Courts may then lift the veil to fix responsibility directly on those individuals.

In Smith, Stone & Knight Ltd. v. Birmingham Corporation (1939), a subsidiary company owned property that was compulsorily acquired by the government. The issue was whether compensation should be paid to the parent company. The court found that the subsidiary had no independent will, acted entirely under the control of the parent, and functioned as its agent. The corporate veil was lifted, and the parent company was treated as the real owner.

In Merchandise Transport Ltd. v. British Transport Commission (1962), the court held that where a company is so completely controlled that it has no separate decision-making authority, it may be regarded as the alter ego of its controllers, justifying lifting of the corporate veil.

#5 Undercapitalization of the Company

- Insufficient Capital at Incorporation: If a company is intentionally started with inadequate capital to meet foreseeable liabilities, courts may view this as an abuse of limited liability.

- Intentional Financial Weakness: Undercapitalization becomes particularly relevant when the company incurs debts knowing it will be unable to repay them. In such cases, shareholders or directors may be personally liable for losses caused to creditors.

In Re: R.G. Films Ltd. (1953), a British company was incorporated with minimal capital and was entirely dependent on an American parent company for financing and decision-making. The court found that the company lacked financial independence and existed merely to secure statutory benefits. The veil was lifted to reveal the true controlling entity.

In Walkovszky v. Carlton (1966) (US case, persuasive value), multiple corporations were formed with minimal capital to operate taxi services, each owning only one vehicle. This structure was designed to limit liability in accident claims. The court observed that deliberate undercapitalization to avoid foreseeable liabilities could justify lifting the corporate veil.

#6 Misuse of Corporate Form

- Abuse of Limited Liability: Limited liability is meant to encourage entrepreneurship, not to facilitate wrongdoing. When individuals take excessive risks knowing they are insulated from consequences, courts may intervene.

- Personal Benefit at the Cost of Creditors: If company assets are diverted for personal use or business is conducted solely for the benefit of controllers while creditors suffer, courts may lift the veil to ensure accountability.

In LIC of India v. Escorts Ltd. (1986), the Supreme Court held that while companies are generally entitled to separate legal personality, the veil can be lifted where the corporate form is misused to defeat law or commit improper conduct. The court clarified that misuse, rather than mere ownership or control, is the key factor.

In Singer India Ltd. v. Chander Mohan Chadha (2004), the court held that when the corporate form is used to unjustly enrich individuals at the cost of others, especially creditors, courts are justified in lifting the veil to ensure fairness.

#7 Group or Subsidiary Companies

- Holding and Subsidiary Company Relationships: In corporate groups, separate legal identities are usually respected. However, courts may lift the veil where subsidiaries are completely controlled and used as mere departments of the parent company.

- When Courts Treat Group Companies as One Entity: If financial, managerial, and operational control is centralized, and subsidiaries have no real autonomy, courts may treat the group as a single economic unit, especially to protect creditors or employees.

In DHN Food Distributors Ltd. v. Tower Hamlets LBC (1976), the court treated a group of companies as a single economic unit because the subsidiaries had no independent business operations and were entirely controlled by the parent company. The corporate veil was lifted to grant compensation to the parent company.

In State of U.P. v. Renusagar Power Co. (1988), the Supreme Court lifted the corporate veil between a holding company and its subsidiary, holding that the subsidiary was created solely to serve the parent company’s interests and had no independent existence.

#8 Public Interest and State Revenue Protection

- Tax Evasion and Economic Offenses: Courts take a strict view when corporate structures are used to undermine public revenue. Shell companies, layered ownership, and artificial transactions designed to hide income may justify lifting the veil.

- National Interest Considerations: In matters involving national security, public welfare, or economic stability, courts prioritize public interest over corporate formalities. Where necessary, the veil may be lifted to expose real beneficiaries and decision-makers.

In Vodafone International Holdings BV v. Union of India (2012), the Supreme Court held that corporate structuring for tax planning is permissible so long as it is genuine and lawful. However, the court clarified that where transactions are sham or intended solely to evade tax, the corporate veil may be lifted in the interest of public revenue.

In McDowell & Co. Ltd. v. CTO (1985), the Supreme Court strongly criticized tax avoidance schemes that rely on artificial corporate arrangements. It held that courts should look at the substance of transactions and lift the corporate veil where corporate structures are used to defeat tax laws and public interest.

Difference Between Lifting and Piercing the Corporate Veil

| Basis of Comparison | Lifting the Corporate Veil | Piercing the Corporate Veil |

| Meaning | The court looks behind the corporate structure to identify the real persons controlling the company | The court completely disregards the separate legal identity of the company |

| Nature | Investigative and explanatory | Punitive and corrective |

| Degree of Disregard | Partial disregard of corporate personality | Complete disregard of corporate personality |

| Purpose | To discover true facts and prevent misuse | To impose personal liability and prevent injustice |

| Corporate Existence | Company’s legal existence is still recognized | Company’s separate legal existence is ignored for liability |

| Imposition of Liability | Liability is not automatic | Personal liability is imposed on shareholders or directors |

| Severity | Less severe | More severe |

| Frequency of Use | Used more frequently by courts | Used rarely and only in exceptional cases |

| Common Situations | Tax matters, regulatory compliance, identifying beneficial ownership | Fraud, sham companies, evasion of legal obligations |

| Jurisdictional Usage | Common in UK, India, and Commonwealth countries | Common in United States jurisprudence |

| Judicial Approach | Courts are relatively liberal | Courts are extremely cautious |

Consequences of Lifting the Corporate Veil

- Shareholders may become personally liable for the company’s debts

- Directors can be held personally responsible for wrongful acts

- Personal assets of shareholders or directors may be used to pay company liabilities

- Limited liability protection of the company is lost

- Courts may ignore the separate legal identity of the company

- Individuals behind the company may face civil liability (damages, compensation)

- Individuals may also face criminal liability if fraud or illegal acts are involved

- Company owners can be ordered to repay loans, taxes, or statutory dues

- Contracts made in bad faith may be declared void or unenforceable

- Regulatory authorities may impose penalties or fines

- Directors may be disqualified from holding future directorships

- The company’s reputation and credibility may be seriously damaged

- Investors and creditors may lose trust in the business

- Courts may treat group companies as one single entity

- Legal costs and litigation risks increase significantly

Defenses Against Lifting the Corporate Veil

Before a court decides to lift the corporate veil, it carefully examines whether the company has been used improperly or dishonestly.

The law generally respects a company’s separate legal identity, and lifting the corporate veil is treated as an exception, not the rule.

If the company is genuinely carrying on lawful business, follows legal requirements, and maintains a clear separation between the company and its owners, the court is less likely to disregard its separate existence.

The following points explain the common defenses a company and its members can rely on to prevent the lifting of the corporate veil.

- The company was formed for a lawful and genuine business purpose

- The company is not a sham or fake entity

- All legal and statutory requirements have been properly followed

- Company records and accounts are properly maintained

- The company has separate bank accounts from its shareholders

- Personal and company finances are not mixed

- Directors act honestly and in good faith

- No fraud, misrepresentation, or illegal activity is involved

- The company is adequately funded for its business operations

- Business decisions are taken by the company itself, not for personal gain

- The company is not used to evade taxes or legal obligations

- Contracts are entered into in the company’s name, not personal names

- Corporate formalities like board meetings and filings are regularly followed

- Shareholders do not exercise improper control over company affairs

- The company operates independently and not as an alter ego of the owners

Conclusion

The doctrine of lifting the corporate veil serves as a crucial exception to the principle of separate legal personality.

While a company is ordinarily treated as an independent legal entity distinct from its shareholders and directors, courts will not hesitate to look beyond this veil when the corporate form is misused.

The primary objective is not to undermine corporate autonomy, but to prevent injustice, fraud, and abuse of law.

Courts may order the lifting of the corporate veil in situations involving fraudulent conduct, evasion of legal or statutory obligations, sham or façade companies, misuse of limited liability, undercapitalization, or where the company acts merely as an alter ego of its controllers.

In such cases, the protection of limited liability cannot be allowed to become a shield for wrongdoing. Judicial discretion plays a central role, and the veil is lifted only in exceptional circumstances, based on facts, intent, and public interest.

From a practical perspective, the doctrine reinforces the importance of sound corporate governance, transparency, and compliance with legal requirements. Companies that maintain proper records, observe statutory duties, and operate in good faith significantly reduce the risk of judicial intervention.

Conversely, individuals who treat a company as a personal instrument expose themselves to personal, civil, and even criminal liability.

FAQs on Lifting the Corporate Veil

What does lifting the corporate veil mean?

Lifting the corporate veil refers to a legal action where a court disregards the company’s separate legal personality and holds shareholders, directors, or promoters personally liable for the company’s conduct when the corporate structure is misused.

When can a court order lifting of the corporate veil?

A court can order lifting of the corporate veil when the company is used to commit fraud, evade legal obligations, avoid taxes, or act as a sham or façade to conceal the true controllers of the business.

Is lifting the corporate veil a common practice by courts?

No, lifting the corporate veil is an exceptional remedy, and courts apply it cautiously, only in cases where adherence to separate legal personality would result in injustice or abuse of law.

Can shareholders be held personally liable after lifting the corporate veil?

Yes, shareholders can be held personally liable if the court finds that they actively participated in fraud, improper conduct, or misuse of the company to escape personal responsibility.

Can directors be made personally liable by lifting the corporate veil?

Directors may be personally liable if they are directly involved in fraudulent acts, misrepresentation, diversion of funds, or illegal activities carried out under the name of the company.

Is fraud necessary for lifting the corporate veil?

Fraud is a major ground but not mandatory in every case, as courts may also lift the corporate veil for evasion of law, tax avoidance, or misuse of corporate personality even without direct fraud.

Can the corporate veil be lifted for tax evasion?

Yes, courts frequently lift the corporate veil in cases of tax evasion where companies are created or used solely to conceal income or unlawfully reduce tax liability.

Can a holding company be liable for the acts of its subsidiary?

A holding company can be held liable if the subsidiary is merely a façade, agent, or alter ego of the holding company with no independent decision-making authority.

Who can request the court to lift the corporate veil?

Creditors, employees, government authorities, tax departments, regulators, or any affected party can request the court to lift the corporate veil by proving misuse of the corporate form.

Does lifting the corporate veil remove limited liability permanently?

No, lifting the corporate veil applies only to the specific transaction or wrongdoing in question and does not permanently eliminate the company’s limited liability status.

Can the corporate veil be lifted in criminal cases?

Yes, courts can lift the corporate veil in criminal cases to identify and punish individuals who commit offenses while hiding behind the corporate structure.

Is undercapitalization a ground for lifting the corporate veil?

Undercapitalization alone is not sufficient, but when combined with dishonest intent or reckless conduct, it may justify lifting the corporate veil.

Can courts lift the corporate veil in employment disputes?

Yes, courts may lift the corporate veil in employment disputes when companies are used to deny statutory benefits, avoid labor laws, or defeat employee rights.

How can companies prevent lifting of the corporate veil?

Companies can prevent lifting of the corporate veil by maintaining proper corporate records, complying with laws, ensuring adequate capitalization, and keeping personal and company affairs separate.

Is lifting the corporate veil based on judicial discretion?

Yes, lifting the corporate veil depends largely on judicial discretion, guided by the facts of each case and the need to uphold justice, equity, and public interest.